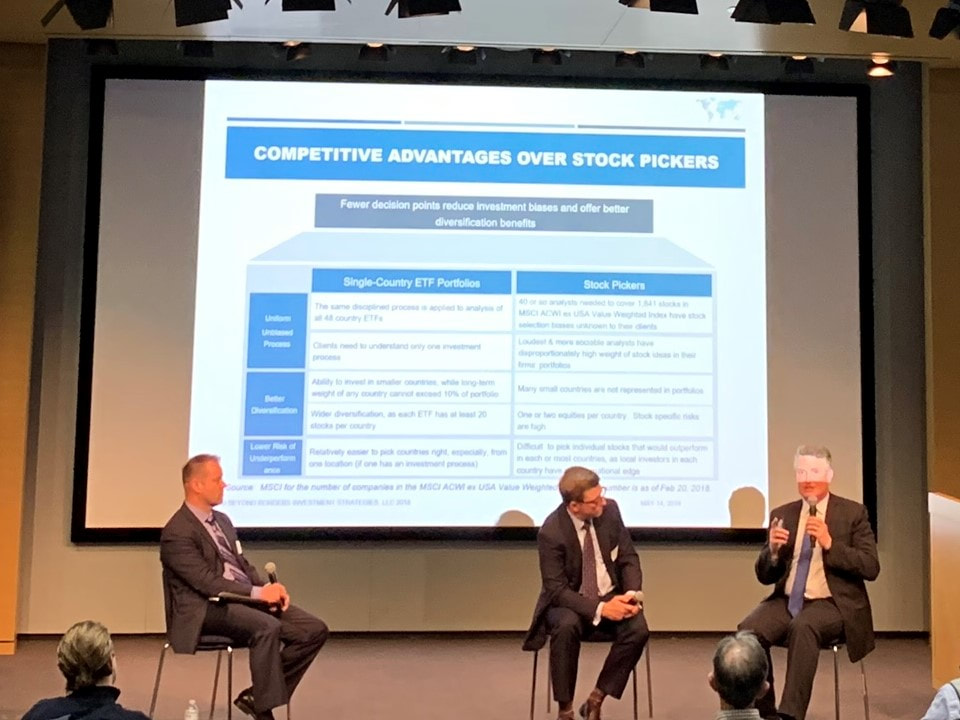

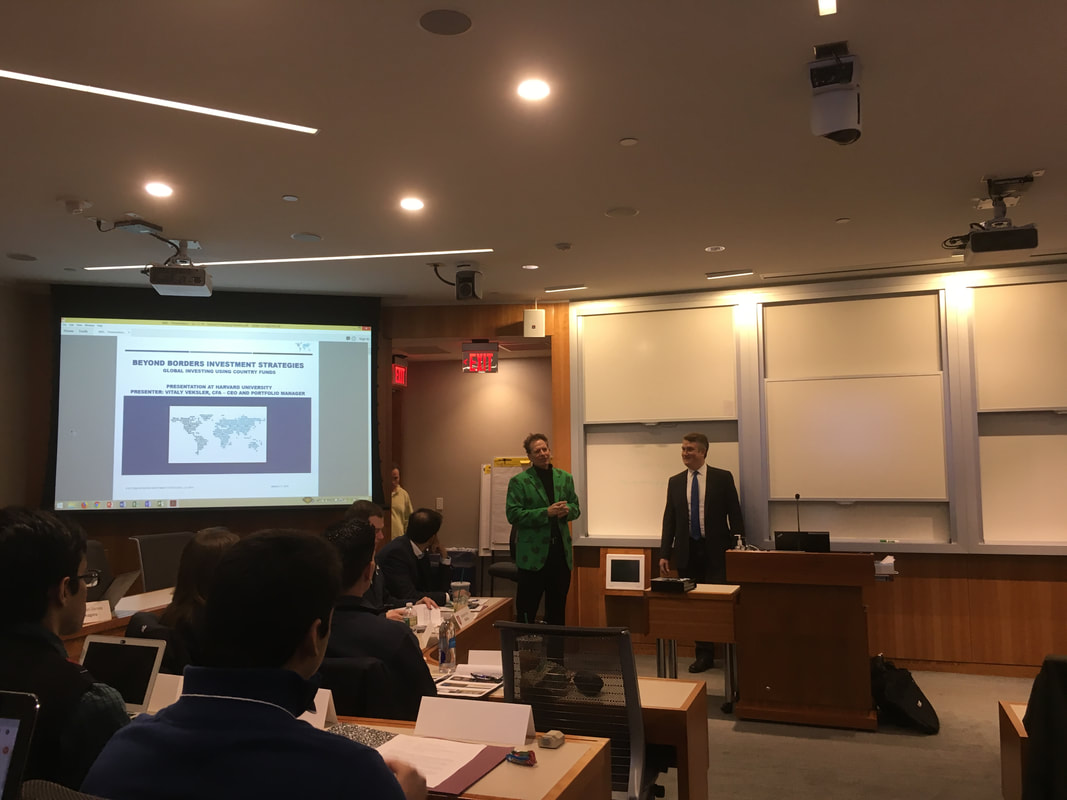

Vitaly Veksler said in a message on LinkedIn, “I was very excited to speak on the Impact Investing panel at the MIT Sloan Investment Conference on Friday. My co-panelists, other speakers, and moderators were “rock stars”. I am grateful to them for their gift of knowledge!

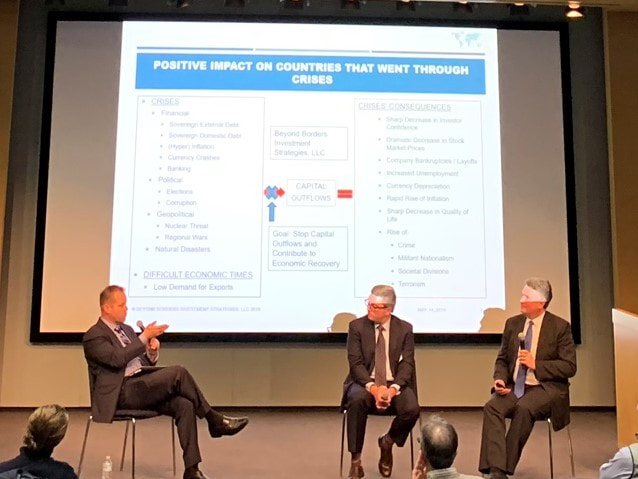

I shared with the audience my non-financial reasons for starting Beyond Borders Investment Strategies. The firm’s impact investment goals are to help crisis-stricken countries and their citizens recover from crises via our investments in single-country equity ETFs, and to contribute to strengthening global security by reducing militant nationalism that often develops during crises and may spill on the international arena in the form of wars or terrorism. I was overwhelmed by the positive feedback from so many people that they expressed in person at the conference and via messages after it.

It is always a pleasure to attend MIT Sloan: I really enjoy seeing my old friends and making new ones. Also, I was very happy that my wife and my son joined me at the conference this year. It was the first time my 9-year-old son attended a conference where I spoke!”

Please let us know if you have questions about Beyond Borders Investment Strategies, LLC by sending a message to [email protected]. Thank you!

RSS Feed

RSS Feed