To see the description of the event, please Click Here

Below is the list of all participants of the Roundtable.

Capital Allocators Roundtable Participants

James Leach, National Trust (Single Family Office)

Clark Cheng, CFA, FRM, CAIA, Merrimac Corporation (Single Family Office)

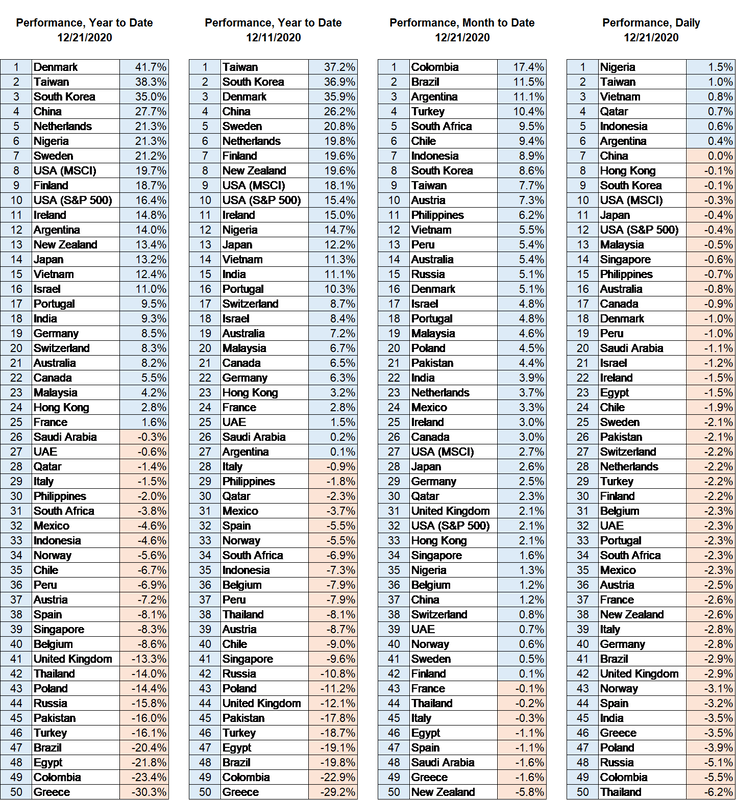

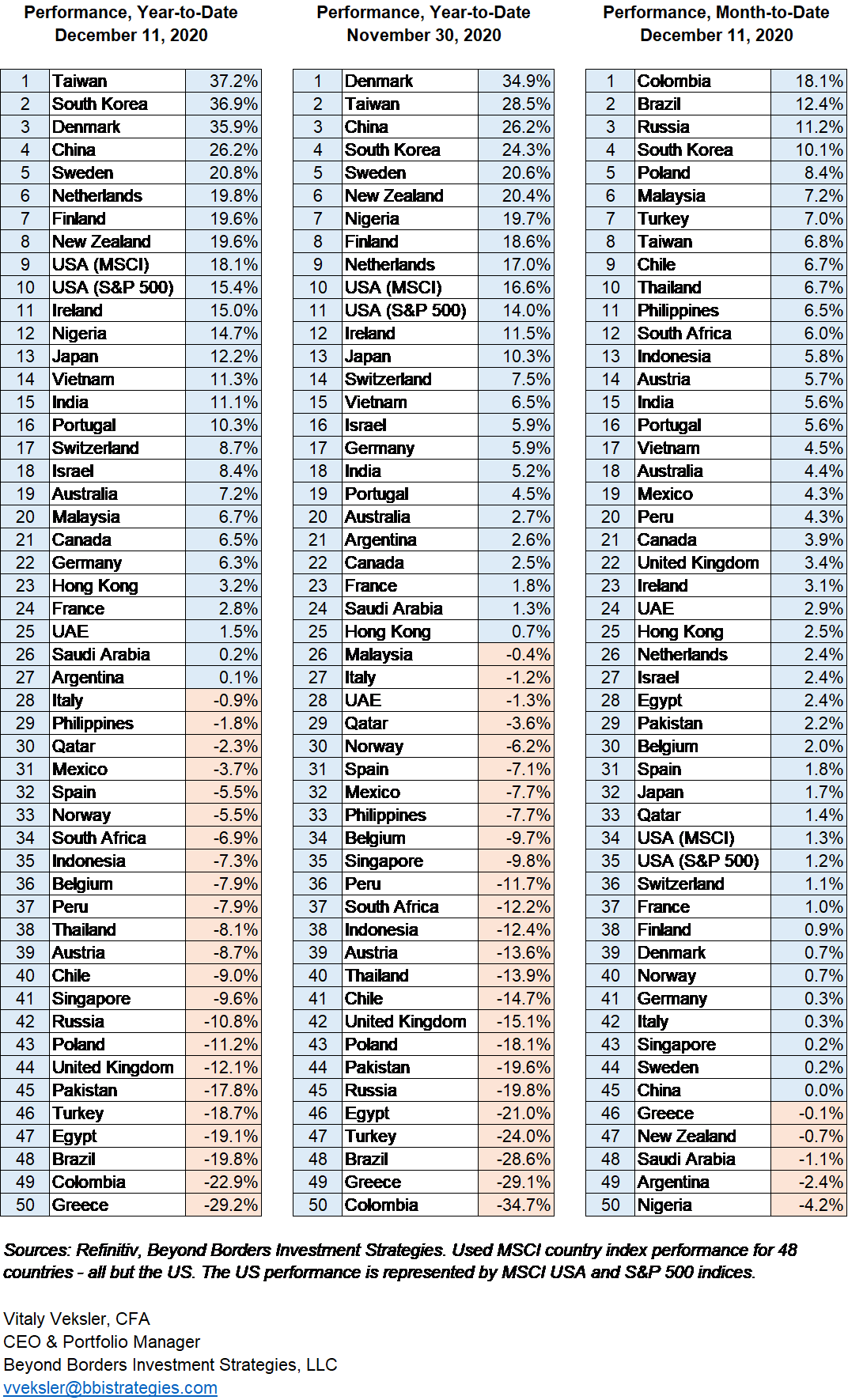

Vitaly Veksler, CFA, Beyond Borders Investment Strategies (Global Macro Investment Firm)

Carrie DiLauro, Hamilton Robinson Capital Partners (Private Equity Firm)

Paul Gray, IronHold Capital (Value-Based Investment Firm) – Moderator

To watch the full recording of the event, please Click Here

After the Roundtable, Vitaly Veksler said the following, “It was a great pleasure to participate in such an exciting Roundtable. I have learned ideas and topics that highly respected professionals from the other parts of the investment industry are exploring in their work. For example, it was very interesting for me to hear perspectives from Clark Cheng and Jim Leach, leaders of two successful single-family offices. I have also really enjoyed hearing about Carrie DiLauro, an Operations and Investment Relations leader, working for a Private Equity firm.

I would also like to compliment Paul Gray for masterfully moderating the Roundtable. Paul is a very informed and well-read investment professional. Through reading and moderating the Capital Allocators Roundtable episodes, Paul has learned and incorporated in his thinking ideas of the top-notch investors. During our conversation, we did not talk only about the ideas of five participants of the Roundtable. We also explored ideas of such investment legends as Ray Dalio of Bridgewater Associates, Steve Cohen of Point72 Ventures, Sam Zell of Equity Group Investments, and others.”

Please let us know if you have questions about Vitaly Veksler’s ideas that he expressed at the Capital Allocators Roundtable or any other topic related to Beyond Borders Investment Strategies, LLC by sending a message to [email protected].

RSS Feed

RSS Feed