To read the report in PDF format, please Click Here

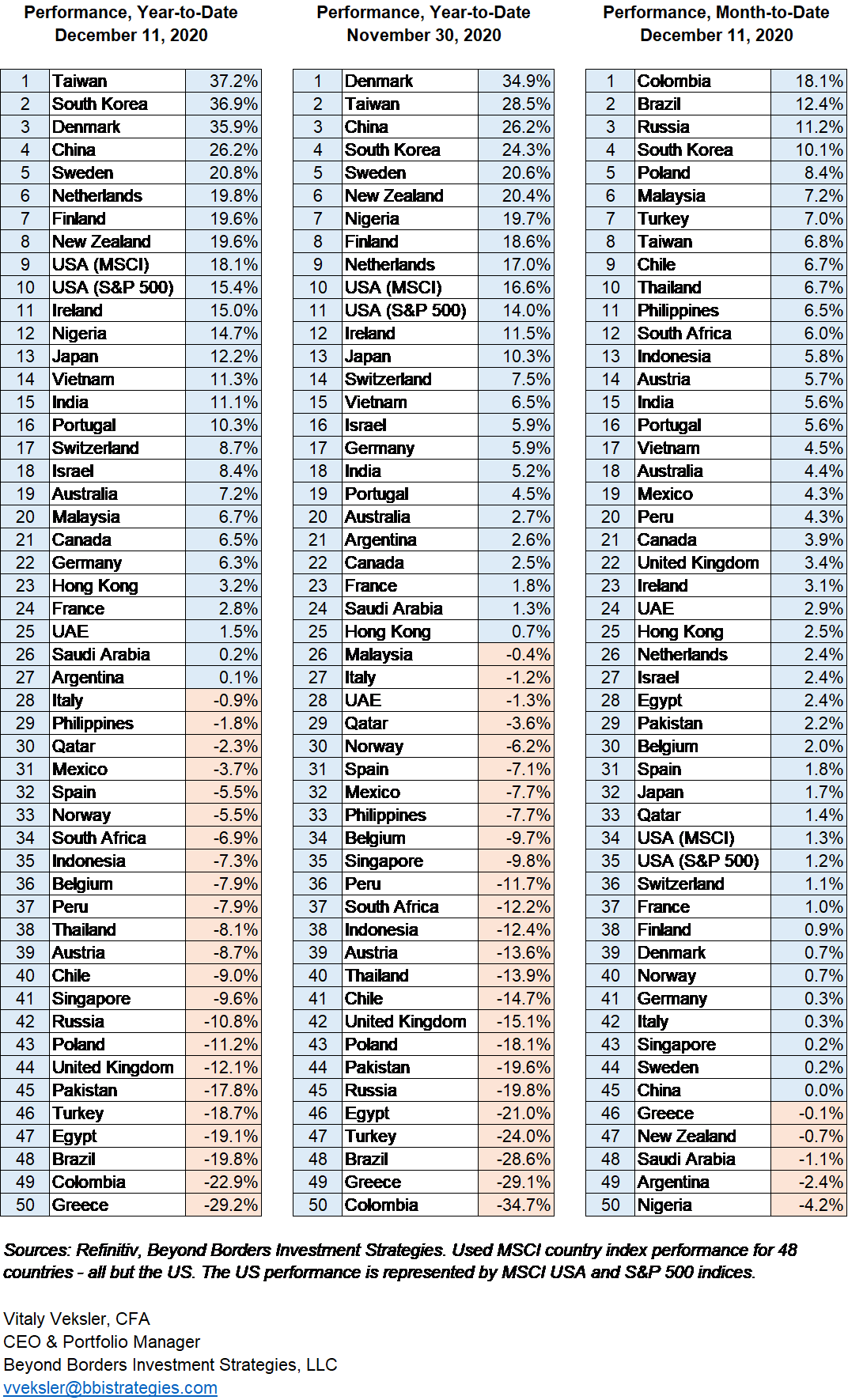

“There were major developments in the world of global equity investing during the first two weeks of December (through December 11, 2020) both among the leaders and laggards. Stock markets of Taiwan and South Korea, two countries with some of the world’s most sophisticated methodologies of responding to the COVID-19 pandemic, had an extremely strong performance in December. While they started the month in the second and fourth place respectively (see the Year-to-Date performance as of November 30, 2020), Taiwan and South Korea, pushed Denmark, a country that was in the first place in the Beyond Borders Investment Strategies’ (BBIS’) 50-index universe for more than eight months to the third place in the table (see the Year-to-Date performance as of December 11, 2020).

Denmark was credited with being one of the first countries to shut down its economy in March and reopening it relatively fast in April. The shutdown was a success because the Danes took it seriously and implemented the social-distancing and other rules that the authorities asked them to follow. As a result of a relatively limited impact of the COVID-19 pandemic on the Danish economy (especially, compared to the devastation it caused in other countries), investors moved their funds into Danish stocks. As a result, MSCI Denmark was the best performer for more than eight months from March 30, 2020 to December 3, 3020. On December 4, 2020, the MSCI Korea index overtook MSCI Denmark as the global leader, only to be overtaken by MSCI Taiwan on December 8, 2020. As of the end of the trading day on Friday, December 11, MSCI indices of these three countries were separated by just 1.3%. MSCI Korea’s total returns (price appreciation and dividends) for 2020 were 37.2%, MSCI Taiwan’s – 36.9% (-0.4%), and MSCI Denmark’s – 35.9% (-1.3%). At BBIS, we think (but do not guarantee) that one of these three countries would take the 2020 performance crown because the rest of the indices are pretty far behind. The difference between MSCI Denmark and MSCI China, which is currently in fourth place with a total 2020 performance of 26.2%, is 9.7%.

Both Korea and Taiwan use computerized systems for contact tracing that allowed these countries to avoid major shutdowns of their economies. In these countries, when people are traced to be in contact with a person who was tested positive for COVID-19, these people are to take a 14-day quarantine. Under this model of fighting the epidemics, most of these countries’ economies, including businesses, remain open. As a reminder, long shutdowns often lead not only to lower growth over the current year or next year, but also to a lower long-term economic growth trajectory for countries that implement them. All over the world, founders of smaller companies, which are more likely to go bankrupt during the shutdowns because they often have less financial reserves needed to survive a long shutdown, may not start new companies in the future. By using their technologically advanced strategies of fighting COVID-19, governments of both Korea and Taiwan have managed to protect their economies and businesses from the devastating impact of shutdowns. As global investors are concerned with the new waves of COVID-19 hitting countries around the world during the winter of 2020, they have moved their funds into stock markets of the two leaders in fighting epidemics. These countries developed these skills based on both mistakes and best practices of fighting the SARS outbreak in 2002-2003, less than 20 years ago. Many other countries, especially at the beginning of the pandemic, benchmarked their strategies to the ones used to fight the Spanish Flu epidemic in 1917-1918, more than a century ago.

There were also dramatic developments at the bottom of the table. Driven by a lower dollar trend, higher expected demand for commodities, and low stock markets valuations, MSCI Colombia had the best performance in December, so far. It grew by 18.1%, which allowed the market to leave the dreaded 50th last place in the BBIS universe. While Brazilian and Russian stock market valuations were not as attractive as those of the Colombian stocks, the lower dollar trend and higher expected demand for commodities led them to post double-digit positive returns in December.

Disclaimer. Opinions expressed in this report are of Beyond Borders Investment Strategies, LLC (BBIS) and are for information purposes only. This report does not represent investment advice. BBIS holds investment positions in single-country equity ETFs of some or all countries mentioned in the report. Past performance is not indicative of future results.”

RSS Feed

RSS Feed