To read the report in PDF format, please Click Here

As I wrote in a LinkedIn post about Beyond Borders Investment Strategies’ previous report titled “December 2020: Major Developments at Both Ends of the Table”, “I love sports and global investing. When I talk to my clients, my colleagues, and my kids (who do not know all intricacies of finance but love sports), I often describe the annual competition among stock markets of different countries as a multistage bicycle race similar to the Tour de France. There are 50 competitors: MSCI stock indices of 48 countries that are represented by at least one single-country equity ETF plus MSCI USA and S&P 500 indices. There are twelve stages (months) and 52 intermediate sprints (weeks).” The biggest prize is to win the overall annual competition by accumulating the highest total return (price accumulation plus dividends) by the end of the day on December 31.

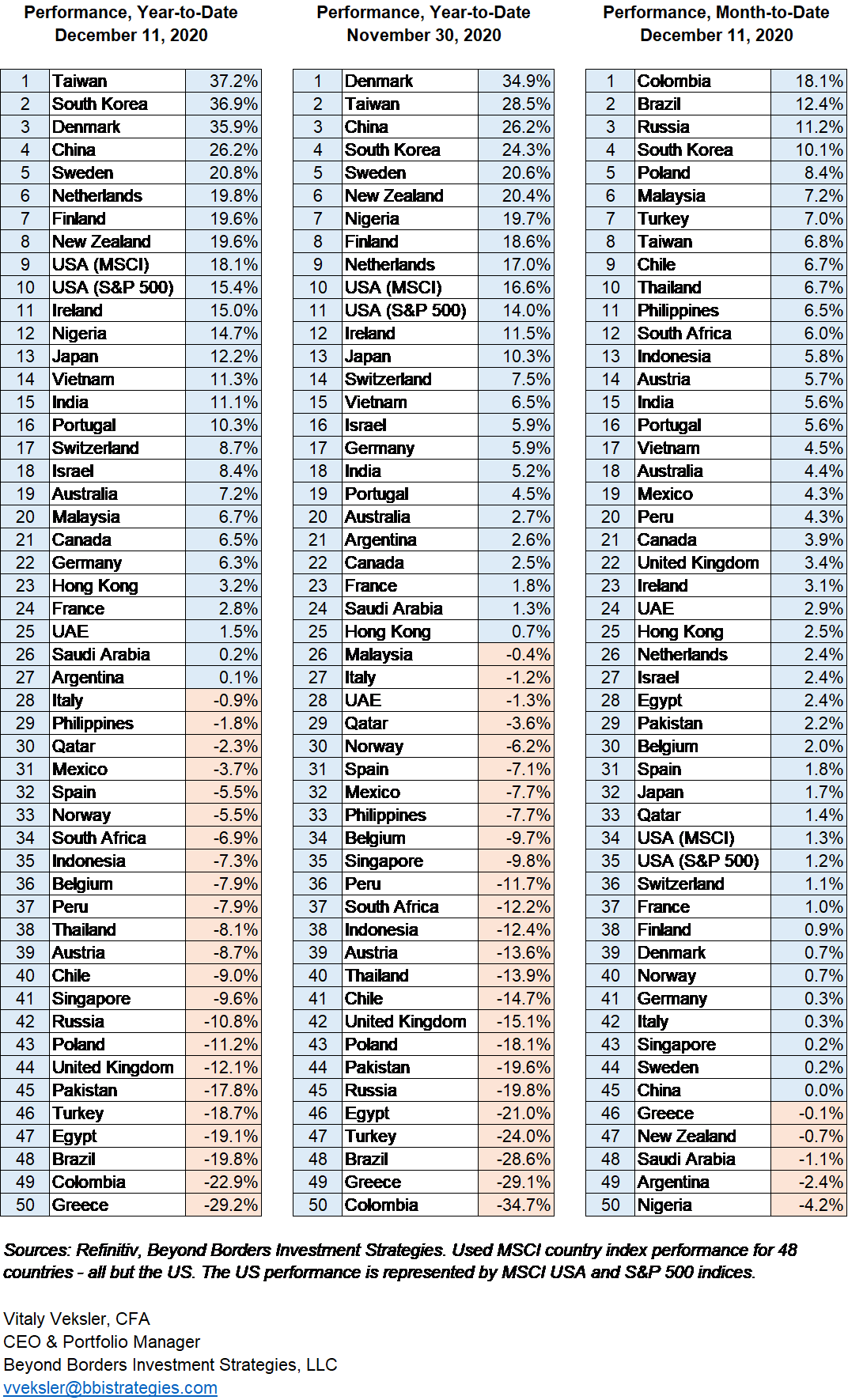

In 2020, the race among the country equity markets may go down to the wire. With seven trading days to go, the difference between MSCI Denmark in the first place and MSCI Taiwan in the second place is 3.4%. MSCI Korea trails MSCI Denmark by 6.7%. As a tired cyclist, who led a long break away from the peloton in a cycling race, MSCI Denmark slowed its growth of total returns by early December after leading for most of eight months since late March. By Friday, December 11, 2020 (when I published the above-mentioned “December 2020: Major Developments at Both Ends of the Table” report), MSCI Denmark lost its leadership and was in third place behind MSCI Taiwan and MSCI South Korea. However, as the cyclist who received the benefit of drafting behind two other cyclists and using less energy needed to overcome air resistance, MSCI Denmark overtook the other two leaders on Monday, December 14, and has been in the first place since then.

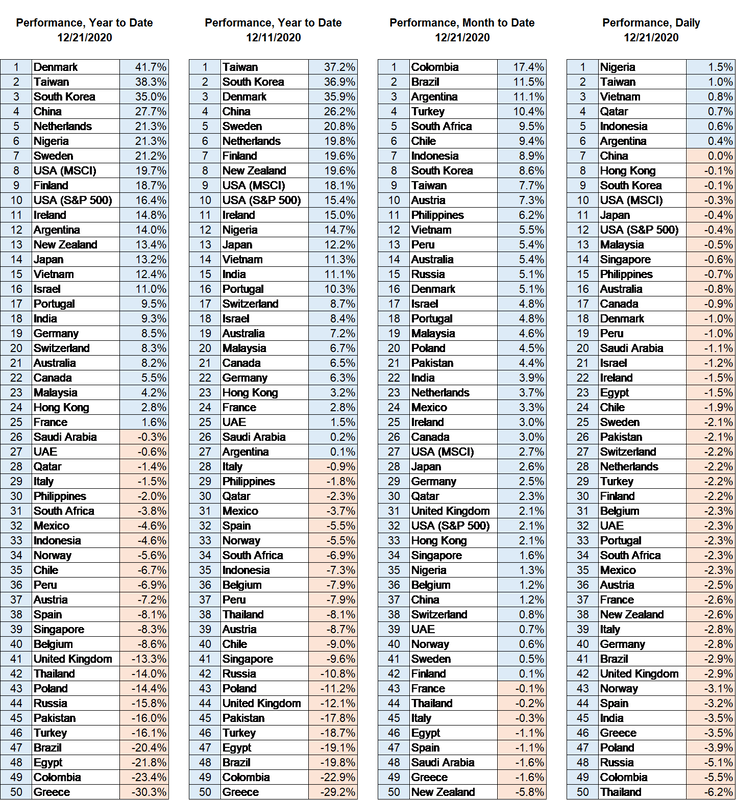

As of the close of the markets last night (December 21, 2020), MSCI Denmark’s total returns for the year were 41.7%, MSCI Taiwan – 38.3%, and MSCI South Korea – 35.0% (see the Year-to-Date Performance table as of December 21, 2020). Currency returns were a major contributing factor for the difference among the “Top 3” total index returns. From December 11 to December 21, Danish Kroner appreciated versus the US Dollar by 0.9%, New Taiwan Dollar stayed almost the same (appreciated by 0.1%), and the Korean Won depreciated by 1.1%

The reason I started this report by saying that the race may go down to the wire is that the difference between the “Top 3” markets is not large and there is a factor that can help the pursuers – MSCI Taiwan and MSCI South Korea. Over the weekend, investors focused on a new especially contagious strand of COVID-19 that was identified in the United Kingdom and described in many publications worldwide. The strand is currently known as “SARS-CoV-2 VUI 202012/01”. In my opinion, yesterday (December 21) most markets had negative returns, some significant, due to this news. [1] For example, MSCI Thailand was in the last 50th place with a negative return of 6.2% (see the Daily Performance table as of December 21, 2020). However, MSCI Taiwan was one of just six markets that had positive returns. It returned 1.0% over the trading session putting it in 2nd place. MSCI Korea dropped by 0.1% (9th place), while MSCI Denmark declined by 1.0% (18th place).

I attribute this performance difference in large part to the fact that Taiwan and South Korea have so far relied on testing-and-tracing practices rather than on the economy-damaging lockdowns to fight the pandemic. Denmark had implemented an efficient and relatively short lockdown in March-April 2020, but still, it was a lockdown. The following comparison of GDP growth rates for 2020 demonstrates the difference in the economic impact of the testing-and-tracing and lockdown strategies. According to GDP forecasts of inflation-adjusted returns measured in local currencies by Oxford Economics, Taiwan’s 2020 GDP is expected to grow 2.5% over its 2019 level, and South Korea’s 2020 GDP is expected to drop by 1.0%. For comparison, Denmark’s 2020 GDP is expected to drop by 4.2% compared to the 2019 levels. In my opinion, if a large number of investors believe that COVID-19 is likely to spread significantly in 2021, MSCI Taiwan and MSCI South Korea may outperform stock markets of countries that rely on lockdowns as the primary defense strategy against the pandemic.

Happy Holidays!

Vitaly Veksler, CFA

CEO & Portfolio Manager

[email protected]

Disclaimer: Opinions expressed in this report are of Beyond Borders Investment Strategies, LLC (BBIS) and are for information purposes only. This report does not represent investment advice. BBIS holds investment positions in single-country equity ETFs of some or all countries mentioned in the report. Past performance is not indicative of future results.

[1] There were other factors impacting performance of individual stock markets around the world, but the news about the new COVID-19 strand negatively impacted most of them.

RSS Feed

RSS Feed