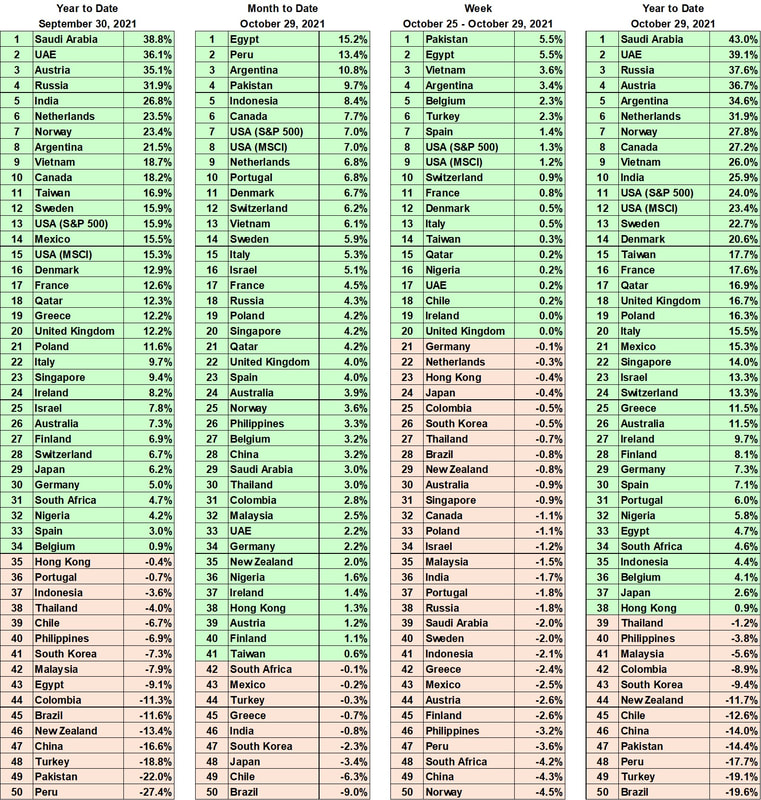

Peru’s Lost Opportunity: As I wrote in a recent report, the MSCI Peru, with its impressive month-to-date returns of 17.6% as of October 22, led the closest competitors in the 50-country-stock-index field - MSCI Indonesia and MSCI Egypt - by 6.9% and 8.4%, respectively. [1] Please find the Performance Tables, including the month-to-date total returns (price appreciation plus dividends), by following the link to the report mentioned above. It is titled “Unknown Unknowns or A Delayed Confirmation Vote for Peru’s Cabinet of Ministers”:

http://bbistrategies.com/our-publications--events/unknown-unknowns-or-a-delayed-confirmation-vote-for-perus-cabinet-of-ministers

I believe the MSCI Peru Index’s rally was sparked by an appointment of Mirtha Vasquez, a moderate Leftist, as Peru’s new Prime Minister on October 6. [2] Ms. Vasquez replaced Guido Bellido, a belligerent Marxist-Leninist who used gas industry nationalization threats during his short (two months and nine days) but tumultuous tenure as Peru’s Prime Minister. Peru’s Congress was to vote to confirm (or not) Mirtha Vasquez’s cabinet of ministers on October 26, 2021. However, the vote was postponed to November 4, 2021, due to the death of Congressman Fernando Herrera Mamani. As a result of the delay and uncertainty associated with the confirmation, the MSCI Peru Index ended the month on a negative note by declining by 3.6% during the last week of the month (October 25-29, 2021).

On the positive side, the MSCI Peru Index’s performance in October, with total returns of 13.4%, allowed the index to get off the last, 50th place, in our rankings. The index was rooted to the bottom of the table after the country elected Marxist-Leninist President Pedro Castillo in July 2021. During his presidential campaign, Mr. Castillo also pledged to nationalize Peru’s mining and hydrocarbon sectors. [3] However, promises made on the political campaign trails, especially the most extreme ones, often, luckily, become less feasible when a person assumes the reins of power. An elected official must deal with the reality of governing (i.e., negotiating with influential people and groups with opposite views) rather than just sloganeering with the supporters.

The October Stage Winner: At the same time, the MSCI Egypt, which was in the third position before the last week, posted the second-best result during the week of October (5.5%) and won the October stage with a total return of 15.2%. In just one month, the MSCI Egypt’s total returns exceeded the 2021 average assumed annual rate of returns of state public pension funds of 7.2%. [4] (Of course, the index, as any other equity investment, does not always go up and may lose value as well). I believe that the MSCI Egypt has clearly benefited from the end of a state of emergency on October 25, four years after it was imposed. Egypt imposed the state of emergency in April 2017 after the deadly bombings of two Coptic Christian churches by the local ISIS affiliate that led to the deaths of more than 40 people and wounds to dozens more. [5] Since it was imposed, the state of emergency was routinely extended at three-month intervals. [6] The state of emergency was lifted because “Egypt has become ... an oasis of security and stability in the region,” as Egypt’s President Abdel Fattah Al-Sisi wrote in a Facebook post. [7] Egypt’s business community welcomed the President’s decision anticipating that it would bring more investments in Egyptian businesses in such sectors as Financials, Information Technology, and Communication Services. [8]

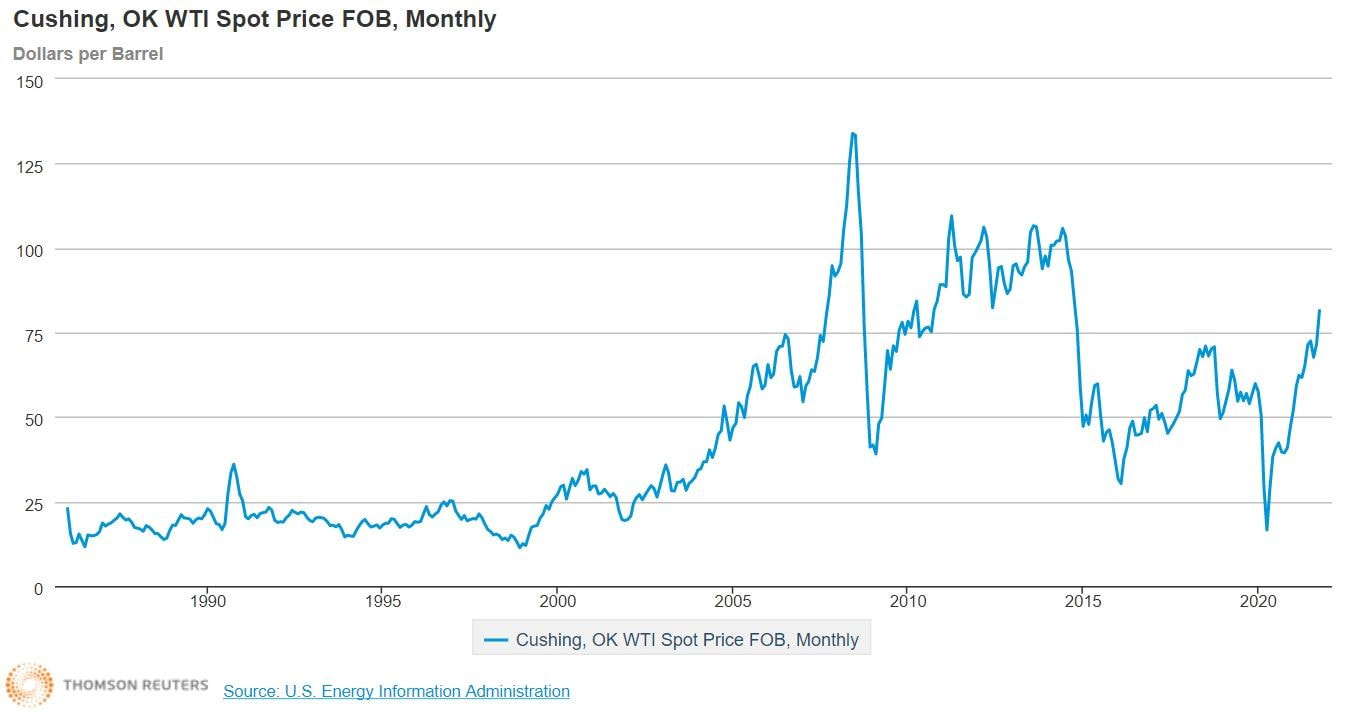

Year-to-Date Leaders: Due to high and still increasing oil prices in 2021, oil-exporting and oil-refining countries continue to occupy seven out of the top eight places in terms of their 2021 year-to-date performance. According to the US Energy Information Administration (EIA), the West Texas Intermediate (WTI) oil price increased by 392% from the end of April 2020 ($16.55) – the pandemic low – to the end of October 2021 ($81.48). [9] See Chart 1 for the monthly WTI prices. From the beginning of 2021 to the end of October, the WTI price increased by 73%, from $47.02 to $81.48. Saudi Arabia tops the list, followed by the UAE, Russia, Argentina, Netherlands, Norway, and Canada. The only Top Eight country that is not a traditional oil producer, Austria (in the fourth place), has a sizable Energy sector weight, 24.29%, as of September 30, 2021. [10] For as long as the oil prices stay high, especially if they continue to increase, the indices of the oil-exporting countries are likely to perform well.

Best regards,

Vitaly Veksler, CFA

CEO & Portfolio Manager

Beyond Borders Investment Strategies, LLC

[email protected]

Footnotes

[1] Vitaly Veksler, Beyond Borders Investment Strategies, “Unknown Unknowns or a Delayed Confirmation Vote for Peru’s Cabinet of Ministers,” October 26, 2021.

[2] Reuters, “Peru’s Congress Postpones Cabinet Confirmation Vote to Next Week,” October 25, 2021.

[3] BBC, “Pedro Castillo Declared President-Elect of Peru,” July 20, 2021.

[4] Equable Institute, “State of Pensions 2021: National Pension Funding Trends,” September 23, 2021.

[5] Al Jazeera, “Egypt’s el-Sisi Lifts State of Emergency in Force since 2017,” October 26, 2021.

[6] Reuters, “Egypt's President Sisi Ends State of Emergency for the First Time in Years,” October 26, 2021.

[7] Ibid.

[8] Daily News Egypt, “Egypt’s Business Community Welcomes President’s Decision to Lift State of Emergency,” October 26, 2021.

[9] US Energy Information Administration (EIA), Petroleum & Other Liquids, Price Table, November 3, 2021.

[10] MSCI Austria Index, Factsheet, September 30, 2021.

Disclaimer: Opinions expressed in this report are of BBIS and are for information purposes only. This report does not represent investment advice. BBIS holds investment positions in single-country equity ETFs of some or all countries mentioned in the report. Past performance is no guarantee of future results

RSS Feed

RSS Feed